By Joshua Gerstin, Esq.

Click here for .pdf version

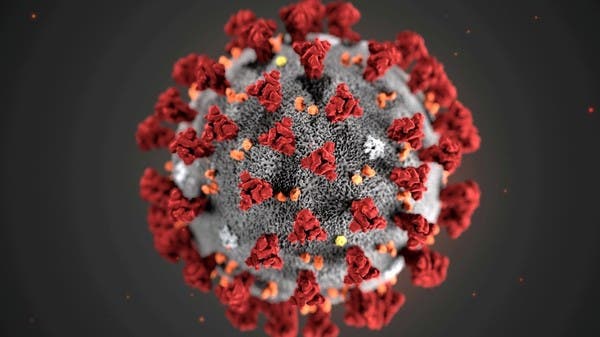

As the COVID-19 vaccine rollout begins to spread across the country two opposing sides are emerging, individuals refusing to get vaccinated and others hoping to refuse them service. Board members across Florida are wondering whether their community association can and should require anybody residing in and/or entering their community to be vaccinated. In short, the answer is not clear. Dealing with a novel virus-induced pandemic brings novel legal challenges without clear answers.

According to the Appellate Court in the case of Hidden Harbour Estates, Inc. v. Norman:

“It appears to us that inherent in the condominium concept is the principle that to promote the health, happiness, and peace of mind of the majority of the unit owners since they are living in such close proximity and using facilities in common, each unit owner must give up a certain degree of freedom of choice which he might otherwise enjoy in separate, privately owned property. Condominium unit owners comprise a little democratic sub-society of necessity more restrictive as it pertains to use of condominium property than may be existent outside the condominium organization. . .”

Hidden Harbour Estates, Inc. v. Norman, 309 So.2d 180 (Fla. 4th DCA 1975).

The Hidden Harbour Court went on to hold the test to determine a rule’s validity is “reasonableness”. Only if a board of directors has the power to adopt a rule, the rule is reasonable, and the rule does not conflict with some other right contained in a superior governing document, can the association adopt it. In this instance, rules requiring members to be vaccinated may conflict with the easements granted to owners to enjoy the common areas (a superior governing document). In addition to possibly conflicting with a member’s easement to enjoy the common areas, vaccines are not yet available to everyone and members will present religious and medical accommodations. As anyone dealing with emotional support animals in a no animal environment will readily explain, there are many easy-to-find medical providers ready, willing, and able (for a fee) to attest to an ailment or affliction to assist a member avoid a rule. Despite their often-dubious attestations, requiring a vaccine and refusing an accommodation based on a medical or religious exemption is difficult and expensive for community associations to fight. Adding the proverbial fuel to the fire is Florida’s lack of a Covid-19 vaccine mandate and pending legislation to strip the Florida Department of Health’s authority to implement a COVID-19 vaccine mandate (HB 6003).

Another problematic issue is increased association liability. In addition to the ever-increasing “HIPPA type” liability that comes from storing health records, community associations will be placing themselves as the weak (and liable) link in a chain if an unvaccinated member sneaks in. Further stoking potential community liability is the science (many people seem to ignore), vaccinated people can catch and transmit COVID-19. Community associations promoting the safety of mingling in their clubhouse or similar area with only vaccinated people may find themselves in a lawsuit from a person infected in an area promoted as safe.

What can a community association do?

Although requiring members to be vaccinated may not be the best approach, requiring individuals other than members to be vaccinated may be a position worth exploring. Depending on a community association’s governing documents, passing rules requiring all vendors for the common areas and elements to be vaccinated is a good first step. Association’s that rent clubhouse rooms or common elements (tennis, bocce, pickleball, etc.) to groups in which outsiders are allowed to participate may also want to consider a vaccine requirement for the outsiders. However, for the reasons expressed above related to members, it is doubtful a community association can prohibit an unvaccinated guest of a member who is not part of a member-group renting an area from using the area with a member.

Until the emergency declaration by Governor DeSantis expires, Florida’s community associations will have extended leeway to propose rules limiting the spread of COVID-19. However, an emergency declaration is not going to overcome the multiple religious and medical accommodations that will be presented in response to a vaccine mandate. Combined with potential liability in storing medical records and the implied notion a common area with only vaccinated people will be 100% safe, community associations looking to require vaccinations should look outward towards their groups that rent common areas and vendors. Combined with this outwardly focus should be a relentless effort on behalf of every community association to educate and promote to its members through easy-to-understand and readily available information the use of the COVID-19 vaccine.

Stay Informed!

Click Here to Subscribe to the Gerstin & Associates Newsletter