By Joshua Gerstin, Esq.

Click here for a .pdf of this article

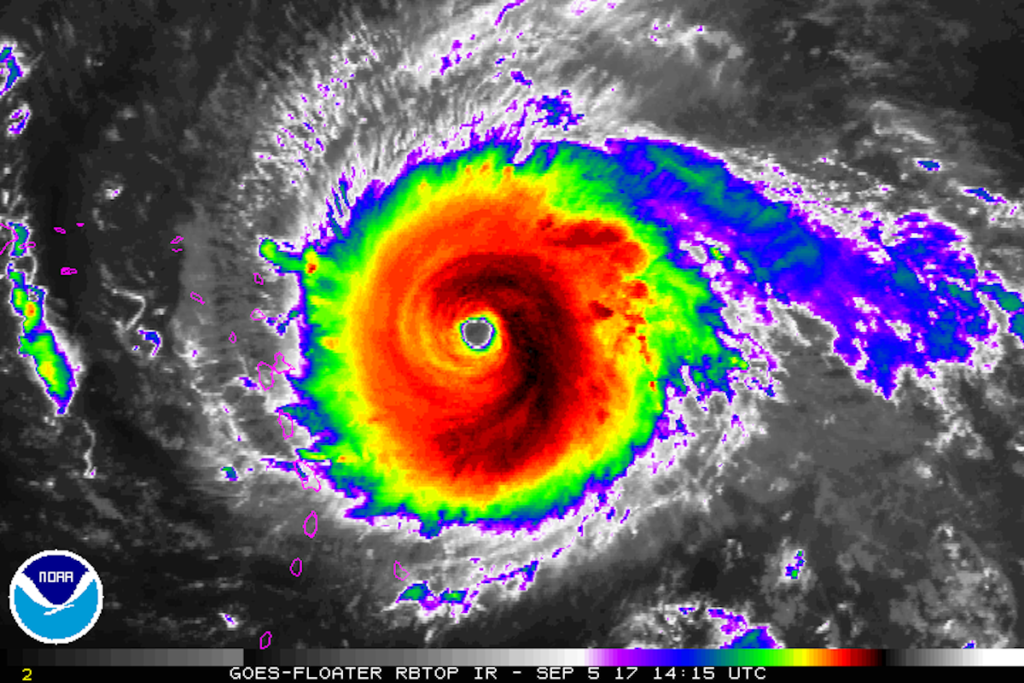

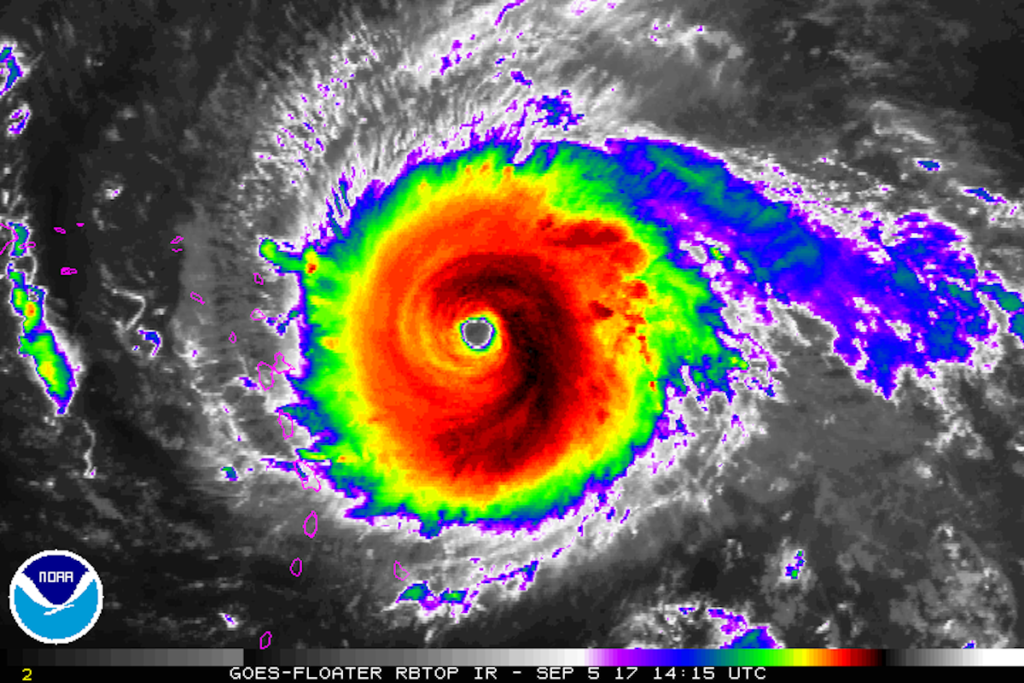

Many community associations are trying to determine whether an emergency special assessment can be levied to pay for the cost of cleanup and damage repairs from Hurricane Dorian. Luckily, Florida has learned a thing a two from past weather disasters and has enacted has special emergency provisions for the operation of homeowner (F.S. §720.316) and condominium associations (F.S. §718.1265).

Based upon an emergency as described in the statute, a condominium or homeowner association can levy an emergency special assessment for, amongst other items, the mitigation of further damage and debris cleanup. Although the usual 14 day notice for a special assessment is not required, associations are still required to give the members some notice. Further, steps may have to be taken to ratify the emergency action taken once normal operations resume. Therefore, before proceeding, consult with your association’s attorney or the attorneys at Gerstin & Associates.

Although the emergency provisions contained in Florida law are broad, not all semblance of order is suspended. For example, statutory emergency special powers do not allow a condominium or homeowner association to “borrow” from a reserve fund to pay for an emergency without the required owner notice and vote. However, it may be possible to levy a special assessment without the required fourteen-day notice to members. Below are the statutory emergency powers available to Florida’s condominium and homeowner associations:

718.1265 Condominium Association emergency powers.—

(1) To the extent allowed by law and unless specifically prohibited by the declaration of condominium, the articles, or the bylaws of an association, and consistent with the provisions of s. 617.0830, the board of administration, in response to damage caused by an event for which a state of emergency is declared pursuant to s. 252.36 in the locale in which the condominium is located, may, but is not required to, exercise the following powers:

(a) Conduct board meetings and membership meetings with notice given as is practicable. Such notice may be given in any practicable manner, including publication, radio, United States mail, the Internet, public service announcements, and conspicuous posting on the condominium property or any other means the board deems reasonable under the circumstances. Notice of board decisions may be communicated as provided in this paragraph.

(b) Cancel and reschedule any association meeting.

(c) Name as assistant officers persons who are not directors, which assistant officers shall have the same authority as the executive officers to whom they are assistants during the state of emergency to accommodate the incapacity or unavailability of any officer of the association.

(d) Relocate the association’s principal office or designate alternative principal offices.

(e) Enter into agreements with local counties and municipalities to assist counties and municipalities with debris removal.

(f) Implement a disaster plan before or immediately following the event for which a state of emergency is declared which may include, but is not limited to, shutting down or off elevators; electricity; water, sewer, or security systems; or air conditioners.

(g) Based upon advice of emergency management officials or upon the advice of licensed professionals retained by the board, determine any portion of the condominium property unavailable for entry or occupancy by unit owners, family members, tenants, guests, agents, or invitees to protect the health, safety, or welfare of such persons.

(h) Require the evacuation of the condominium property in the event of a mandatory evacuation order in the locale in which the condominium is located. Should any unit owner or other occupant of a condominium fail or refuse to evacuate the condominium property where the board has required evacuation, the association shall be immune from liability or injury to persons or property arising from such failure or refusal.

(i) Based upon advice of emergency management officials or upon the advice of licensed professionals retained by the board, determine whether the condominium property can be safely inhabited or occupied. However, such determination is not conclusive as to any determination of habitability pursuant to the declaration.

(j) Mitigate further damage, including taking action to contract for the removal of debris and to prevent or mitigate the spread of fungus, including, but not limited to, mold or mildew, by removing and disposing of wet drywall, insulation, carpet, cabinetry, or other fixtures on or within the condominium property, even if the unit owner is obligated by the declaration or law to insure or replace those fixtures and to remove personal property from a unit.

(k) Contract, on behalf of any unit owner or owners, for items or services for which the owners are otherwise individually responsible, but which are necessary to prevent further damage to the condominium property. In such event, the unit owner or owners on whose behalf the board has contracted are responsible for reimbursing the association for the actual costs of the items or services, and the association may use its lien authority provided by s. 718.116 to enforce collection of the charges. Without limitation, such items or services may include the drying of units, the boarding of broken windows or doors, and the replacement of damaged air conditioners or air handlers to provide climate control in the units or other portions of the property.

(l) Regardless of any provision to the contrary and even if such authority does not specifically appear in the declaration of condominium, articles, or bylaws of the association, levy special assessments without a vote of the owners.

(m) Without unit owners’ approval, borrow money and pledge association assets as collateral to fund emergency repairs and carry out the duties of the association when operating funds are insufficient. This paragraph does not limit the general authority of the association to borrow money, subject to such restrictions as are contained in the declaration of condominium, articles, or bylaws of the association.

(2)The special powers authorized under subsection (1) shall be limited to that time reasonably necessary to protect the health, safety, and welfare of the association and the unit owners and the unit owners’ family members, tenants, guests, agents, or invitees and shall be reasonably necessary to mitigate further damage and make emergency repairs.

720.316 Homeowner Association emergency powers.—

(1) To the extent allowed by law, unless specifically prohibited by the declaration or other recorded governing documents, and consistent with s. 617.0830, the board of directors, in response to damage caused by an event for which a state of emergency is declared pursuant to s. 252.36 in the area encompassed by the association, may exercise the following powers:

(a) Conduct board or membership meetings after notice of the meetings and board decisions is provided in as practicable a manner as possible, including via publication, radio, United States mail, the Internet, public service announcements, conspicuous posting on the association property, or any other means the board deems appropriate under the circumstances.

(b) Cancel and reschedule an association meeting.

(c) Designate assistant officers who are not directors. If the executive officer is incapacitated or unavailable, the assistant officer has the same authority during the state of emergency as the executive officer he or she assists.

(d) Relocate the association’s principal office or designate an alternative principal office.

(e) Enter into agreements with counties and municipalities to assist counties and municipalities with debris removal.

(f) Implement a disaster plan before or immediately following the event for which a state of emergency is declared, which may include, but is not limited to, turning on or shutting off elevators; electricity; water, sewer, or security systems; or air conditioners for association buildings.

(g) Based upon the advice of emergency management officials or upon the advice of licensed professionals retained by the board, determine any portion of the association property unavailable for entry or occupancy by owners or their family members, tenants, guests, agents, or invitees to protect their health, safety, or welfare.

(h) Based upon the advice of emergency management officials or upon the advice of licensed professionals retained by the board, determine whether the association property can be safely inhabited or occupied. However, such determination is not conclusive as to any determination of habitability pursuant to the declaration.

(i) Mitigate further damage, including taking action to contract for the removal of debris and to prevent or mitigate the spread of fungus, including mold or mildew, by removing and disposing of wet drywall, insulation, carpet, cabinetry, or other fixtures on or within the association property.

(j) Notwithstanding a provision to the contrary, and regardless of whether such authority does not specifically appear in the declaration or other recorded governing documents, levy special assessments without a vote of the owners.

(k) Without owners’ approval, borrow money and pledge association assets as collateral to fund emergency repairs and carry out the duties of the association if operating funds are insufficient. This paragraph does not limit the general authority of the association to borrow money, subject to such restrictions contained in the declaration or other recorded governing documents.

(2) The authority granted under subsection (1) is limited to that time reasonably necessary to protect the health, safety, and welfare of the association and the parcel owners and their family members, tenants, guests, agents, or invitees, and to mitigate further damage and make emergency repairs.

Stay Informed, Subscribe to the Gerstin & Associates Newsletter

Name: _________________________________________________

Mailing address: ________________________________________

E-mail address: _________________________________________

Community name: ________________________________________

Position on board, if any: __________________________________

Fax this completed page to (561) 750-8185 or email the above information to: joshua@gerstin.com